J.P. Morgan Healthcare Conference Special: Dealmaker of the Year 2024 (Part 01)

Shots:

- The first dose of the J.P. Morgan Special: Dealmaker of the Year report based on the total number of deals signed in 2024

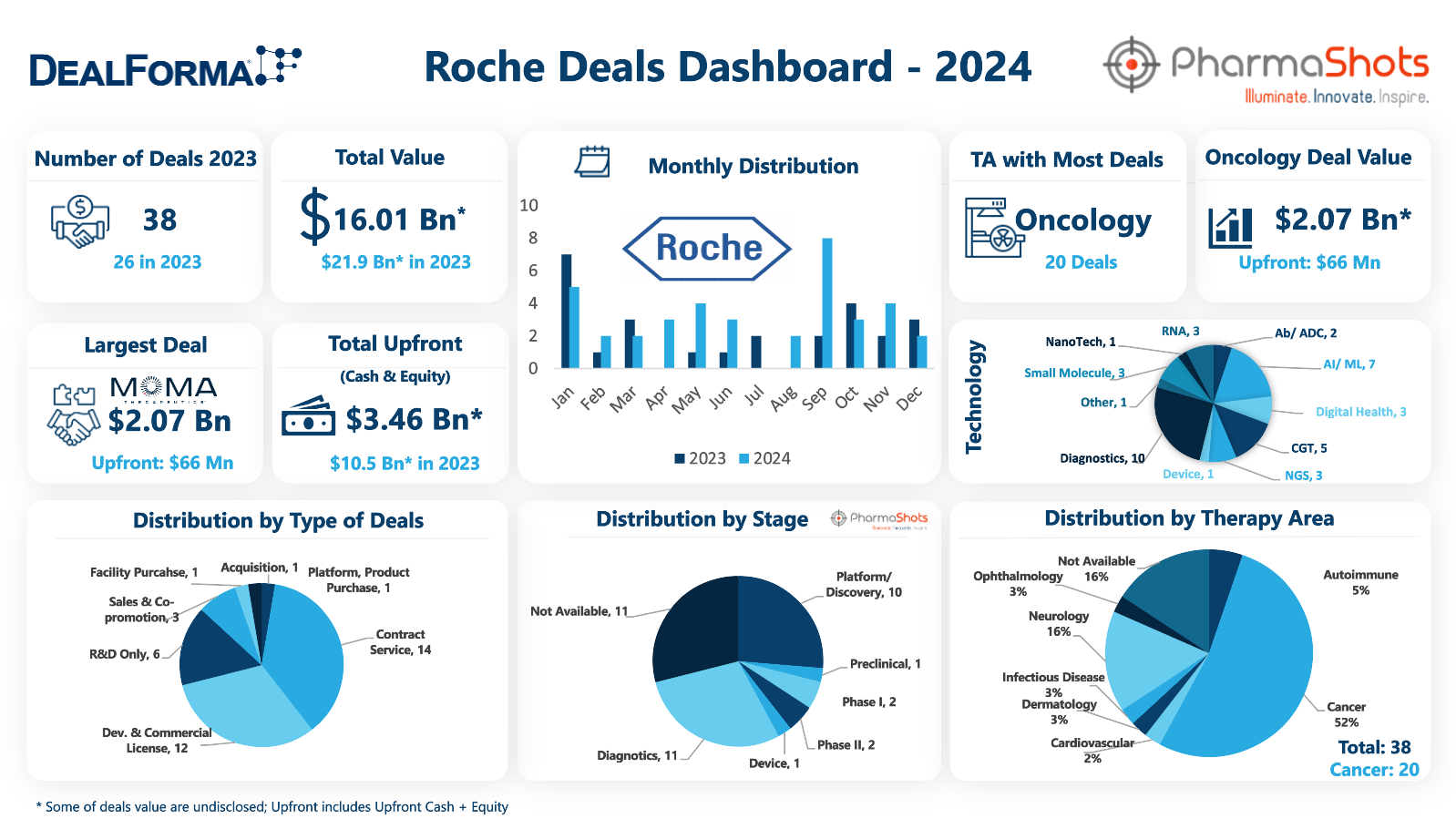

- Last year, Roche inked 38 deals comprising acquisitions, contract services, development & commercialization, facility purchase, R&D, platform/product purchases, and sales/co-promotion

- Leveraging DealForma’s invaluable insights, PharmaShots brings an on-demand report on the Dealmaker of the Year 2024

Overview

In 2024, the pharmaceutical industry saw reduced participation in mergers and acquisitions (M&A) compared to prior years. While the volume of deals signed in 2024 paints an optimistic picture, the overall value per deal reflects a significant decline compared to 2023. The J.P. Morgan Special Dealmaker of 2024 (Part 1) highlights the company with the highest number of deals registered during the year. As in the previous year, Roche retained its top position by signing the most deals in 2024.

The report spotlights Roche, a Swiss multinational healthcare company operating across biopharma, medical devices, diagnostics, and health-tech sectors. Roche is renowned for developing therapies targeting oncology, immunology, ophthalmology, cardiovascular, and respiratory diseases. The company operates through two primary divisions: Pharmaceuticals and Diagnostics. In 2023, Roche generated total sales of $69.78B, with pharmaceutical sales accounting for $52.99B. Key contributors to its revenue were lead assets such as Ocrevus ($7.6B), Hemlibra ($4.9B), and Perjeta ($4.5B).

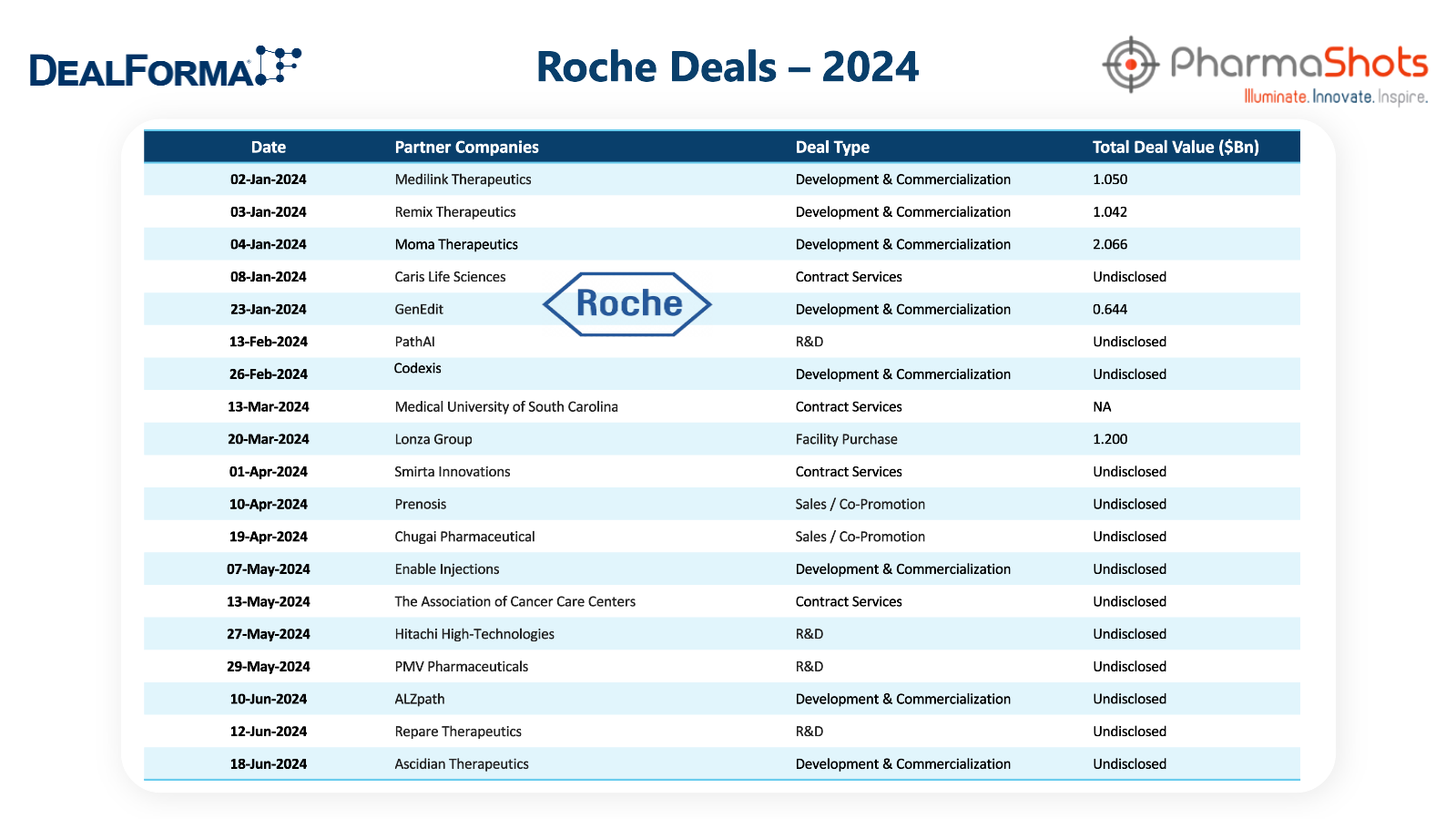

In 2024, Roche engaged in approximately 38 signed collaborations, including acquisitions, contract services, development and commercialization agreements, R&D partnerships, and product purchases. The total announced deal value, excluding undisclosed deals, amounted to $16B. Of the 38 deals, the majority fell under contract services (14 deals) and development and commercialization licensing agreements (12 deals).

Insights:

- In 2023, Roche emerged as the top dealmaker in terms of volume, signing 26 deals valued at $21.9B. In 2024, the company signed approximately 38 deals, collectively worth $16B

- January was a particularly most dealmaking month for Roche in 2023, while September proved to be the most fruitful month in 2024

- In 2023, Roche primarily focused on development and commercialization deals as well as R&D partnerships. However, in 2024, the company shifted its focus to contract service agreements

Top Deals for Roche

1. Roche Signed a Development and Commercial License with Moma Therapeutics

- MOMA Therapeutics granted Roche exclusive, worldwide rights to develop and commercialize therapies using MOMA's KnowledgeBase platform for the treatment of cancer

- MOMA will be responsible for development activities through confirmation while Roche will be responsible for further activities. Additionally, MOMA has the right to co-fund the development of one late-stage therapy in exchange for additional royalties in the US

- MOMA will receive $66M up front and is eligible for up to $2B in development, regulatory, and commercial milestones, plus tiered royalties

2. Sangamo Therapeutics Announced Global Epigenetic Regulation and Capsid Delivery License Agreement with Genentech

- Sangamo granted Genentech exclusive, worldwide rights to its zinc finger repressors to develop anti-tau therapies for treating Alzheimer’s and an undisclosed neurology target. Additionally, Sangamo licensed its adeno-associated virus (AAV) capsid, STAC-BBB to develop and commercialize multiple genomic candidates for neurology targets

- Sangamo will initially be responsible for certain preclinical activities and tech transfer. Genentech will oversee clinical development and lead regulatory interactions, manufacturing, and commercialization

- Sangamo will receive $50M up front including near-term milestones and is eligible for up to $1.9B in development and commercial milestones for multiple targets, plus royalties

- The alliance will discover small molecule therapeutics targeting undrugged transcription factors in oncology, using Flare’s proteomic & mass spectrometry platform as well as electrophilic compounds library

- Flare will lead discovery & preclinical work plus is entitled to get $70M up front in cash, >$1.8B discovery, development & commercialization milestones along with royalties, while Roche will handle further development & commercialization

- Flare keeps the right to co-fund the development of one target in exchange for higher US royalties. It also retains ownership of its pipeline, incl. FX-909 for advanced urothelial cancer (entering IND-enabling trials) as well as other oncology & therapeutic programs

- Ascidian Therapeutics and Roche have signed a research collaboration and licensing agreement to discover and develop RNA exon editing therapies for neurological disorders under which Roche gains exclusive rights to Ascidian’s RNA exon editing technology for undisclosed targets

- Ascidian, with Roche, will handle discovery & specific preclinical activities while Roche will oversee further preclinical & clinical development, manufacturing plus commercialization

- The agreement offers Ascidian an initial $42M and an additional $1.8B research, clinical & commercial milestones plus global sales-based royalties. Ascidian is free to develop other neurological targets independently or in partnership

5. Roche to Acquire Poseida Therapeutics for ~$1.5B

- Roche will acquire Poseida for $9/share in cash, strengthening its CAR-T therapy portfolio, with the deal closing in Q1’25

- Roche will also pay a total of $4/share non-tradeable CVR as milestones ($2 for pivotal trial of P-BCMA-ALLO1 by Dec 2028, $1 for a pivotal trial of P-CD19CD20-ALLO1 or P-BCMACD19-ALLO1 in autoimmune indication by Dec 2034 & $1 for P-BCMA-ALLO1’s sale by Dec 2031), valuing the deal at ~$1.5B

- Acquisition adds Poseida’s P-BCMA-ALLO1 (in P-I for MM), P-CD19CD20-ALLO1 (in P-I for B-cell malignancies, with FDA INDs for multiple sclerosis & SLE), another allogeneic dual CAR-T therapy for hematologic malignancy, P-MUC1C-ALLO1 (in P-I for solid tumors), GMP manufacturing capabilities plus genomic pre-clinical medicines & related tech

Disclaimer:

- PharmaShots has not included University deals

- Overall deal value is higher than mentioned as Roche has ~26 undisclosed deals

Related Posts: J.P. Morgan Special: Deal Maker of the Year 2023 (Part 01)

Tags

An avid reader and a dedicated learner, Prince works as a Content Writer at PharmaShots. Prince possesses an exceptional quality of breaking down the barriers of words by simplifying the terms in digestible chunks to make content readable and comprehensible. Prince likes to read books and loves to spend his free time learning and upskilling himself.